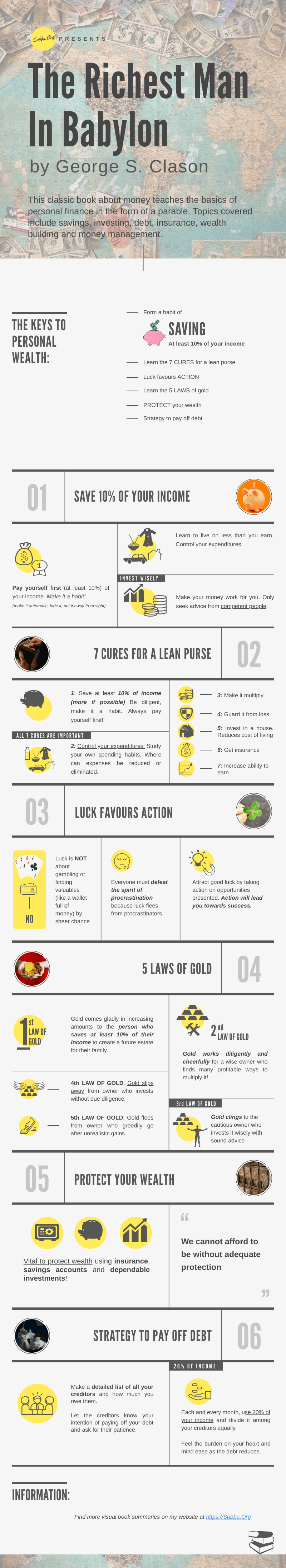

This is a visual book summary of the classic book The Richest Man in Babylon by George S Clason. The book teaches the basics of personal finance in the form of a parable. Topics covered include savings, investing, debt, insurance, wealth building and money management.

Visual Book Summary Of The Richest Man In Babylon (Infographic)

- If you liked the visual book summary then do

Here are some of my insights from the infographic visual book summary of The Richest Man in Babylon by George S Clason:

The Keys To Personal Wealth

- Form a habit of SAVING at least 10% of your income

- Learn the 7 CURES for a lean purse

- Luck favours ACTION

- Learn the 5 LAWS of gold

- PROTECT your wealth

- Strategy to pay off debt

1. Save 10% Of Your Income

Pay yourself first (at least 10%) of your income. Make it a habit! Make it automatic, hide it, put it away from sight.

Control your expenditures. Learn to live on less than you earn.

Invest wisely. Make your money work for you. Only seek advice from competent people.

2. Seven Cures For A Lean Purse

- Save at least 10% of income (more if possible) Be diligent and make it a habit to always pay yourself first!

- Control your expenditures: Study your own spending habits. Which expenses can be reduced or eliminated?

- Make your money multiply by investing it wisely.

- Guard your money from loss.

- Invest in a house. It reduces the cost of living.

- Get insurance so that your family and loved ones are secure should anything happen to you.

- Increase your ability to earn. Always be sharpening your current skills and learning new skills so that your ability to earn increases.

3. Luck Favours Action

Luck is NOT about gambling or finding valuables (like a wallet full of money) by sheer chance.

You can attract good luck by taking action on opportunities presented. Action will lead you towards success.

To be successful, you must defeat the spirit of procrastination because luck flees from procrastinators.

4. Five Laws Of Gold

1st Law: Gold comes gladly in increasing amounts to the person who saves at least 10% of their income to create a future estate for their family.

2nd Law: Gold works diligently and cheerfully for a wise owner who finds many profitable ways to multiply it!

3rd Law: Gold clings to the cautious owner who invests it wisely with sound advice.

4th Law: Gold slips away from owner who invests without due diligence.

5th Law: Gold flees from owner who greedily go after unrealistic gains

5. Protect Your Wealth

We cannot afford to be without adequate protection

George S. Clason

It is vital to protect your wealth using a combination of insurance, savings accounts and dependable investments.

Do your research.

6. Strategy To Pay Off Debt

Make a detailed list of all your creditors and how much you owe them. Let the creditors know your intention of paying off your debt and ask for their patience.

Each and every month, use 20% of your income and divide it among your creditors equally.

Feel the burden on your heart and mind ease as the debt reduces.

After the debt is paid off, you can invest this additional 20% as you have already learned to live within your means. This will help you reach your financial goals much faster.

What Next?

- Share it on social media:

Do share your thoughts below: